- Mutlu Bir Gelecek İçin

- 444 7 694

- 0 332 235 63 08

- bilgi@miskoleji.com.tr

Martingale Exchange Risk Government

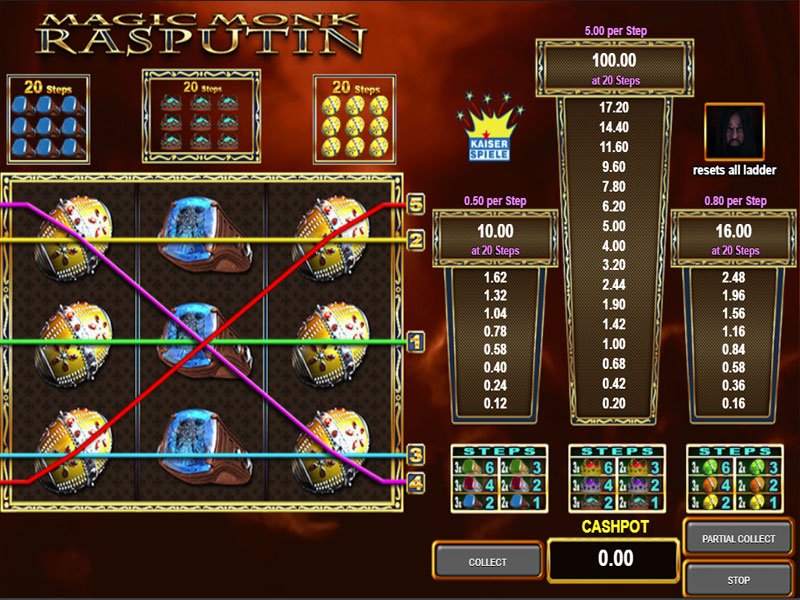

Quickspin Sloty i Zabawy kasynowe TOP Spis Kasyn

27 Kasım 2024Jimi Hendrix Position totally free revolves no deposit stinkin steeped Done Remark banana splash online pokie review Delight in Demonstration 100percent free in the Asia

27 Kasım 2024Blogs

However, as everyone knows, principle has a tendency to work differently than just behavior. Such as, the brand new Martingale exchange system cannot take into account the psychological cost one to such as a technique plays the new buyer https://mrbetlogin.com/golden-7-classic/ otherwise gambler. To learn the basics at the rear of the strategy, let’s consider a basic analogy. Suppose you have a coin and engage in a gambling video game away from possibly thoughts or tails with a starting wager out of $step 1. There is certainly the same possibilities that coin often property on the minds or tails, each flip is independent (the previous flip doesn’t change the consequence of another flip).

It does attempt to optimize the fresh long-label rate of growth of your account while you are trying to do away with the fresh chance of destroy. Similarly, in the event the trade program appears to find the correct environment and you can is actually gaining by realizing a number of successful investments and you can financing enjoy, it can accommodate more risk you need to take. Right here, we’re going to focus on the matter-of simply how much so you can risk to the a swap.

It indicates forex investors pursuing the martingale means can be counterbalance a great part of their losings that have interest money. Guess you have a coin and you can take part in a gaming online game having one to buddy out of possibly heads or tails which have a starting bet of $step 1. There is the substitute for render a predetermined worth for each and every exchange or estimate they dynamically centered on a percentage of the balance. Very carefully think about your exposure threshold whenever determining the newest trade dimensions, as it myself influences the quantity you are happy to chance per trade. Furthermore, business standards, such as sudden speed motions otherwise openings, may cause high losses even with smaller wager types, subsequent undermining the brand new Martingale method’s abilities. Let’s say beginning with $fifty and rehearse the brand new Martingale approach inside the a binary options exchange otherwise a comparable scenario where you can double forget the.

Gate.io Place Martingale Trading Bot

By considering genuine-lifestyle advice and you can putting on information from specialists in industry, bettors can make informed decisions regarding the incorporating the new Martingale Means on the its playing strategy. Consider, gambling always carries intrinsic dangers, and is essential to gamble sensibly and you can inside your setting. Furthermore, betting and gambling experts emphasize the necessity of knowing the fundamental math of the Martingale Approach. It establish the approach’s capabilities relies on the first choice size, chances of the video game, and also the gambler’s exposure endurance. Experts warning one blindly using the method instead of provided such items may cause extreme financial losses. Some other inspiring victory facts concerns a team of members of the family just who applied the newest Martingale Way to the sports betting projects.

Related Words

The fresh Martingale method inside the the forex market operates to the concept from imply reversion, which implies you to prices have a tendency to return on the historic averages. Because of this even throughout the evident declines, the chances of a good money few’s worth interacting with no are minimal. By the continuously increasing the condition proportions after every losings, buyers aspire to capitalize on the brand new eventual speed modification. Dating back to the newest eighteenth millennium, the new Martingale method is centered on chances principle.

Although not, it is crucial to keep in mind that there are zero pledges within the sports, as well as an educated procedures is fail. By consolidating the fresh Martingale Means with comprehensive look, investigation, and you will responsible playing methods, gamblers can increase their probability of success. Also, in the blackjack, participants increases its wagers after each losings. As an example, if the a player loses a hands, they could twice its wager on the following give, hoping for a winnings that will security the prior loss.

From the increasing (or considerably growing) the career dimensions after each shedding trade, traders can be efficiently mediocre on the entryway speed. This approach appeals to crypto fans with enough time-label believe inside a particular cryptocurrency however, predict quick-identity rates action. Growing positions through the dips allows investors to help you take advantage of rates reversals and finally gain benefit from the cryptocurrency’s up path. This strategy comes to doubling your own choice after every loss to recover past losses and you may earn a profit equivalent to your brand new share. Martingale is a method to gambling that involves increasing your own bet after every loss.

Although not, of numerous players found on their own facing tall losses and you may was eager to are able to recover their money. It was in this perspective you to definitely Paul Pierre Lévy Martingale set up his greatest approach. These types of currency sets take into account more change regularity within the the market industry.

The original trade size is calculated based on the account balance and risk tolerance, also it sets the newest baseline for the next adjustments after the losses. The fresh allure of your own Martingale means is dependant on its possible for rapid data recovery and you may money, but it is fraught which have high dangers. One of the primary threats ‘s the possibility to eliminate a complete trading membership while in the a long shedding streak. The need to constantly twice as much reputation proportions can deplete the funding, especially in unstable areas, putting some martingale program a dangerous method. This plan works for the premise you to definitely rates will ultimately rebound, making it possible for investors to split actually and you can profit. Such as, for many who start with a great $10 trading and get rid of, another exchange was $20, up coming $40, and stuff like that.

Digital Choices Martingale Trading Method Told me

As well as, with forex currency trading, manner last very long, and you can up until it finishes, the newest development is the pal. If you think about this, the danger-prize proportion isn’t that beneficial possibly. Whether gambling at the gambling establishment otherwise trade bonds, nobody wants to lose.

Be sure that you provides recognized the risks in it and you can apply best risk government or seek independent advice if required. Remember, it’s required to do your homework, and you can approach trade which have a level lead as opposed to counting on a high-exposure means which have dubious much time-identity possible. The theory is that, the idea is always to double down on your stock financing all of the date it goes off inside worth. The belief is that eventually, the fresh stock usually rebound, and also you’ll recoup your losses along with make money. While we merely temporarily said, the new Martingale strategy is a gaming program you to originated in 18th-100 years France.

The brand new trading means assumes you to areas at some point return on the mean, however, this isn’t secured and certainly will result in extended episodes away from loss. It’s also important to notice that method may cause a number of brief gains followed closely by a devastating loss, removing all past progress. The brand new Martingale approach was create for gambling on the people game with the same probability of an earn or a loss. The stock exchange is not a zero-share game (finally, but just about no-contribution from the short run) rather than as simple as betting for the an excellent roulette desk.

Given Slices Speed because of the 0.25%; Holds Come to Levels

The fresh Martingale strategy is actually to begin with applied to a casino game in which the gambler wagers for the whether or not a coin manage house minds otherwise tails. The brand new martingale strategy generally means you happen to be increasing down the brand new entryway rate each time you generate a trade if you don’t reach money more than their address time. To correctly play which trade approach, you desire a huge duplicate of money.