Kurumsal

Sevgili Öğrencilerimiz,

Değerli Velilerimiz ve Kıymetli Eğitimcilerimiz,

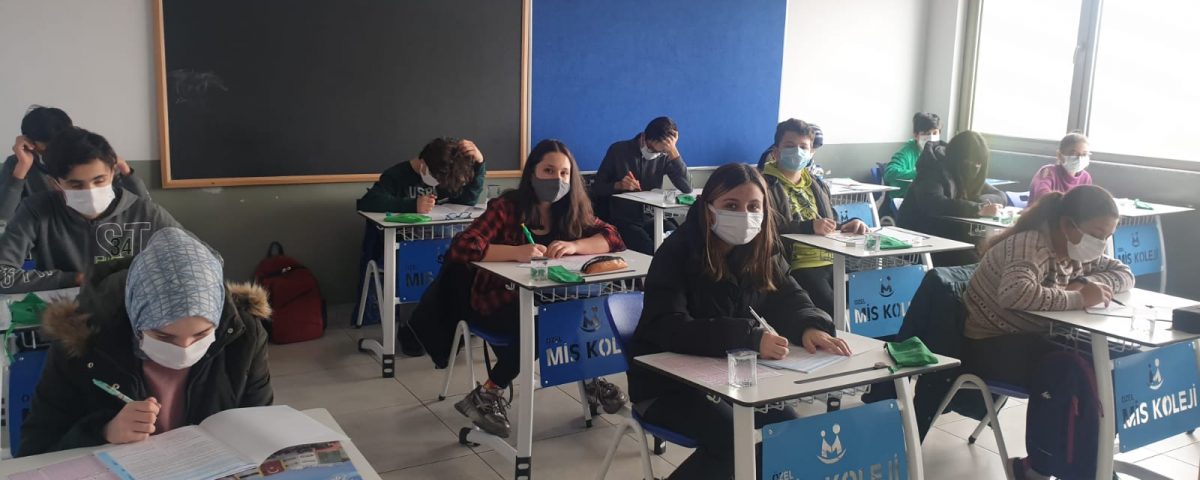

Eğitim, bir toplumun en büyük gücüdür. Mis Koleji olarak bizler, sadece akademik başarıyı değil, ahlaki değerleri, bireysel gelişimi ve evrensel düşünmeyi de temel alan bir eğitim anlayışını benimsiyoruz.

Mis Koleji Yönetim Kurulu Başkanı

Salih ÖZKAN

EĞİTİM PROGRAMI

+

ÖĞRENCİ

+

EĞİTİM KADROMUZ

Misden Eğitimlerimiz

Akademik Eğitim

Akademik Eğitimde Mis Koleji Farkı

Mis Koleji, geleceğin liderlerini ve bilim insanlarını yetiştirme misyonuyla öğrencilerine çağdaş, bilimsel ve tekno...

Yabancı Dil Eğitimi

Yabancı Dil Eğitiminde Mis Koleji Farkı

Mis Koleji olarak, öğrencilerimizin küresel dünyada başarılı olabilmesi için dil becerilerini geliştir...

Değerler Eğitimi

Mis Koleji Değerler Eğitimi ile Geleceğin Sorun Çözebilen Bireyleri Yetiştiriyoruz

Mis Koleji olarak, öğrencilerimizin sadece akademik alanda değil, ...

Misden Etkinliklerimiz

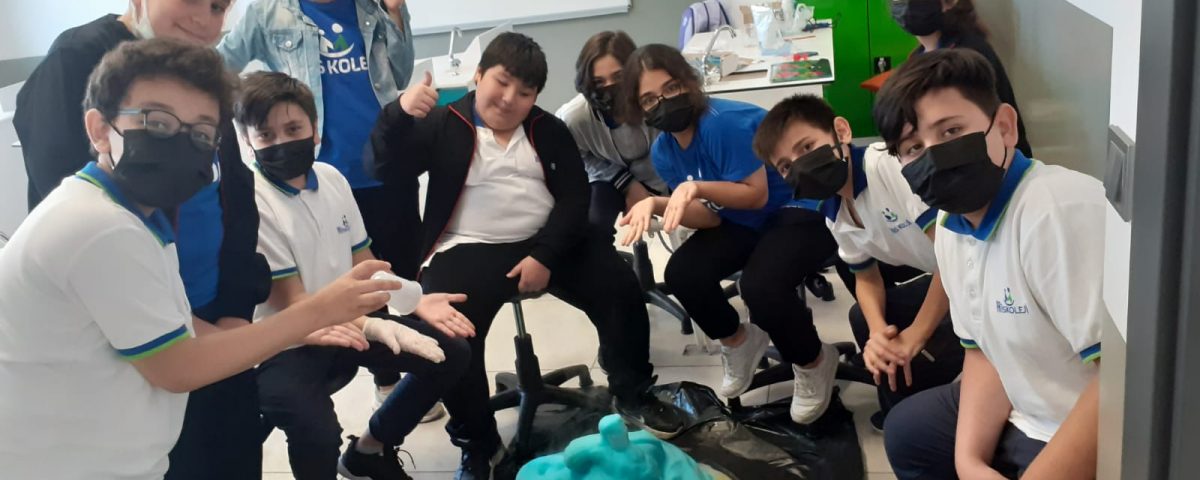

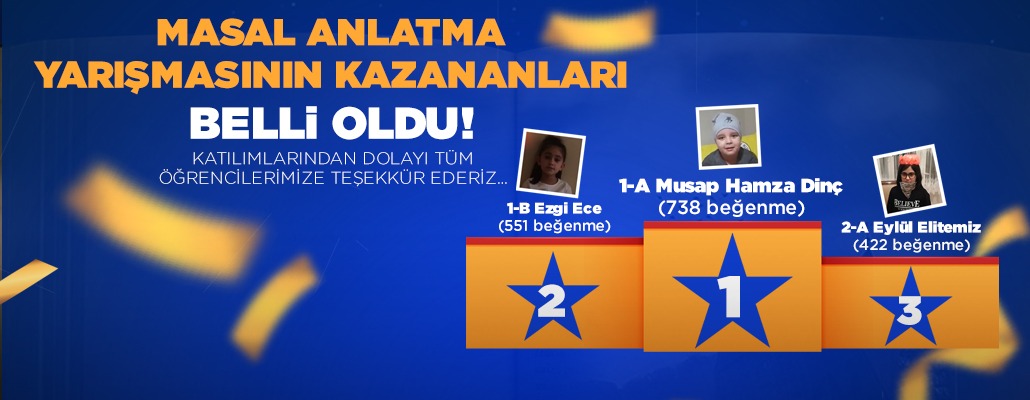

Öğrencilerimizin bilimsel ve analitik düşünme becerilerini geliştiren proje ve yarışmalar düzenliyoruz.

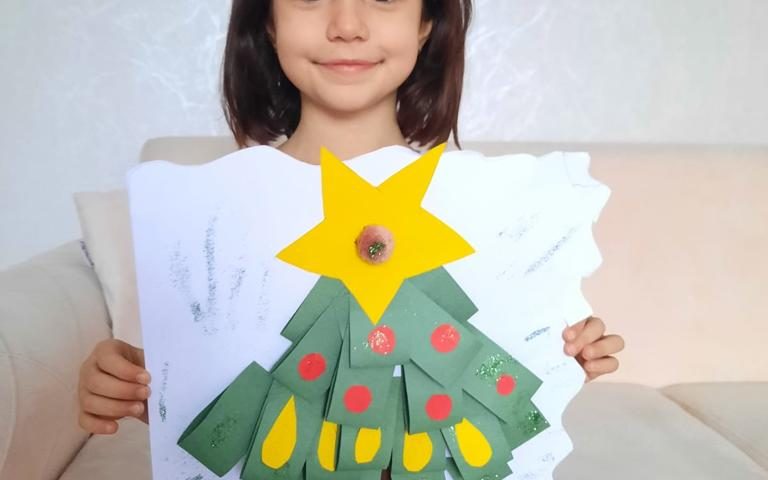

Resim, müzik, tiyatro ve dans etkinlikleriyle öğrencilerimizin yaratıcılığını destekliyoruz.

Takım ruhunu güçlendiren spor turnuvaları ve doğa gezileri düzenliyoruz.

Mis Store

Mis Storeda, okulun kıyafetleri ve giyim kuralları hakkında bilgilere ulaşabilirsiniz..

Mis Store

Eğitmen Girişi Yap

Eğitmen girişi yaparak, eğitmen olarak yazılar oluşturabilir ve içeriklerinizi paylaşabilirsiniz.

Eğitmen GirişiEğitmenden Yazılarımız

Eğitmenlerimizin eğitim, rehberlik ve gelişime dair paylaşımlarını keşfedin.

Tümünü İncele

Matematikte başarılı olmak, disiplinli bir çalışma ve doğru yaklaşımlar gerektiri...

Yazıyı İnceleAli ATABEK

Matematik ÖğretmeniHaberlerimiz

Mis Koleji yeni eğitim öğretim yılına hazır

Mis Kolejinde Bahar Şenliği Coşkusu Başladı

...- Mis Koleji